How to raise a VAT reverse charge invoice for a customer using Okappy and Xero

From 1st March 2021, if you supply goods and services to the construction sector, then you will need to implement VAT reverse charging on your invoices.

Domestic reverse charge VAT legislation (DRC) is a change in the way Construction Industry Scheme (CIS) registered construction businesses handle and pay VAT. It is being introduced in the UK on 1 March 2021, having previously been delayed from October 2019.

Read on for step by step instructions on raising an invoice with a VAT reverse charge.

Set up a Xero Domestic Reverse Charge tax rate

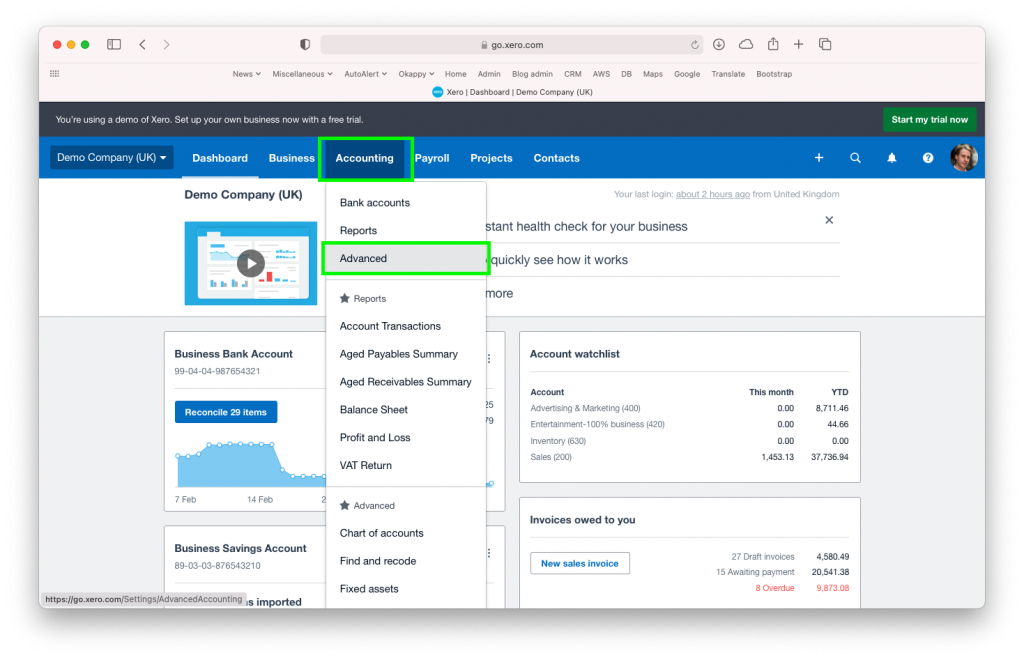

From within Xero,

- Go to the Account menu

- Select Advanced

- Click Add Domestic Reverse Charge Tax Rates

- Click Add Domestic Reverse Charge Tax Rates to confirm

For more information, see Xero support.

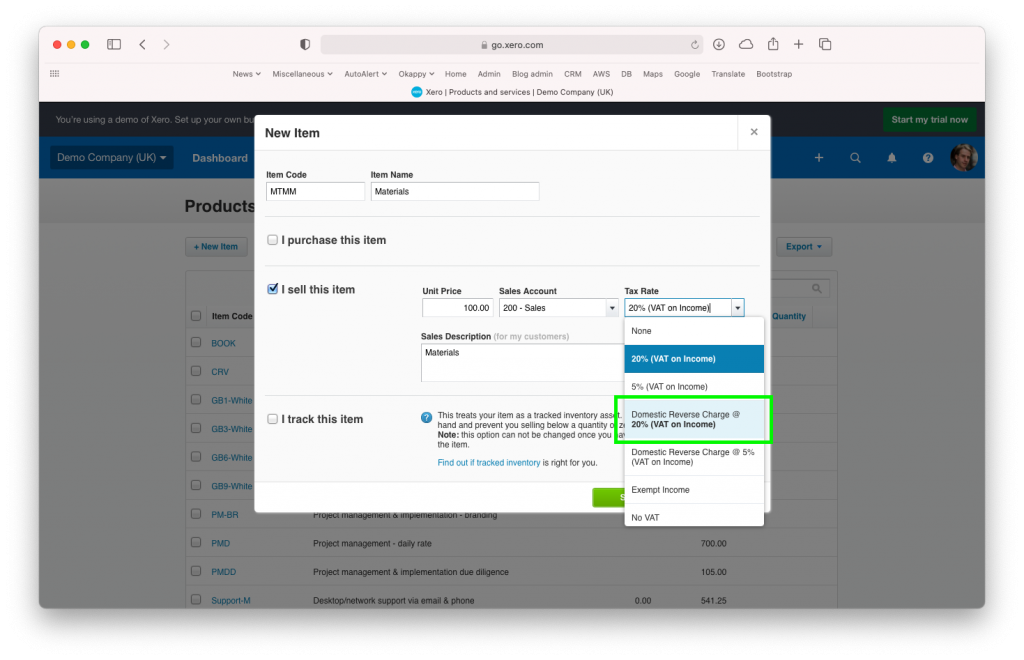

Add/edit a product or service in Xero

To add or edit a product or service to include the VAT reverse charge

- Go to the Business menu

- Select Products and Services

- Edit an existing Item, or select + New Item

- Enter the details for your item including the Unit Price, Sales Account and Description

- Select the new Domestic Reverse Charge rate you added previously.

- Click Save

Set up your customer for CIS in Okappy

Set up your customer in Okappy as a CIS customer

- Go to the Connections menu

- Find the relevant customer

- Click Account settings

- Check VAT reverse charge

- Enter the CIS rate

Raise your invoice and export to Xero

- Raise your invoice for your customer

- Select the item which you added in Xero

The tax rate will automatically update to show Reverse charge applied and the total VAT will be updated.

The final invoice will show that Reverse charge applies and that the customer to account to HMRC for the reverse charge output tax on the VAT exclusive price of items marked reverse charge at the relevant VAT rate as shown above.

You can export your invoices to Xero and the line items and tax rate will be automatically calculated in Xero.

See How to export your invoices to Xero for more information.

For more information on raising invoices, see

For further information

For further information search in our support pages or forum