The VAT Reverse Charge legislation was introduced in March 2021. Over 20 minutes we discussed how the VAT reverse charge works, when you should use it and how to configure Okappy along with your other systems to provide VAT reverse charge invoices to your customers.

Introducing Okappy

Okappy is a business two business connected workforce management platform which applies social and market networking technology to a real business need using our unique Portal+ platform. The need to communicate and collaborate with your employees who are often at different locations (and now more than ever). With your subcontractors and with your customers.

Okappy helps the most forward looking and dynamic companies increase transparency, reduce duplication, costs and errors and increase efficiency. Ultimately making a significant contribution to bottom line profits.

With Okappy, you can connect to your employees, customers and subcontractors.

- Send and receive jobs

- See the status of those jobs as they’re updated by your engineers and subcontractors

- Then raise your invoices at the touch of a button

It’s that last stage which was the reason for the webinar.

What is the VAT Reverse Charge

From 1st March 2021, if you supply goods and services to the construction sector, then you will need to implement VAT reverse charging on your invoices

Before VAT Reverse charge, you would have paid VAT on products or services bought in the UK. You would declare the total amount of VAT you are going to pay to HMRC that quarter, and also the total amount of VAT you are going to reclaim.

Domestic VAT reverse charge legislation (DRC) is a change in the way Construction Industry Scheme (CIS) registered construction businesses handle and pay VAT. It was introduced at the start of this month, having previously been delayed from October 2019.

The reason why HMRC are introducing it is because they’ve identified construction as one of the leading sectors for VAT fraud where some sub-contractors claim VAT but never pay it.

By moving the VAT charge to the end user, HMRC intends to make this kind of fraud impossible. So now, sub-contractors will require the contractor employing them to handle and pay the VAT directly to HMRC.

Who does it affect?

The new legislation affects all VAT registered businesses who supply or receive construction and building services that are reported under the CIS.

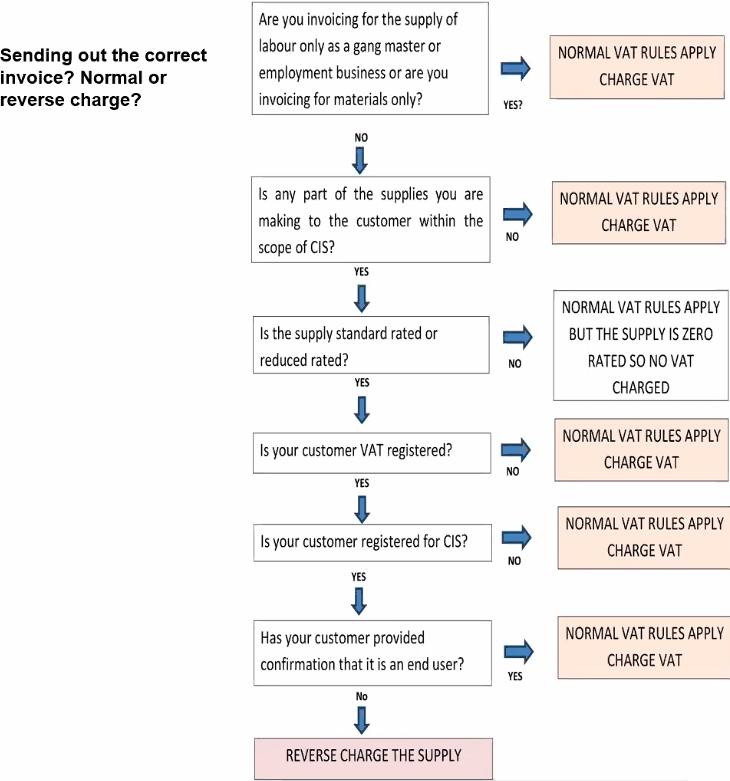

Checklist

- Check when you must use the reverse charge

- Find out how the charge works if you supply products and services

- Find out how the charge works if you purchase products and services

- Understand how your systems work with the VAT reverse charge

- Consider the impact on your cashflows

- Provide training to staff

We talked about how the VAT reverse charge works with Okappy and with Xero. If you’re using other accounting software, you’ll need to check that your software is up to date, especially if you have older desktop based systems.

You also want to think how it could affect your cashflow especially if you are paying a lot of VAT on supplies but now not receiving VAT from your customers. It may be worth changing over to HRMC’s monthly repayment trader scheme. Either way, it is worth planning out your bills over the next couple of quarters when cash flow will be at its most difficult.

When must it be used?

It must be used if you’re a VAT registered company operating within the Construction Industry Scheme (CIS). But, it must only be used in specific circumstances. It applies to materials if they’re used as part of a service provided under CIS. Not if they are provided independently.

- Your customer must be VAT registered in the UK

- The payment for supply is reporting within CIS

- Services are being supplied at the standard or reduced rate

- You are not an employment business

- You’re customer is not an end user or intermediary supplier.

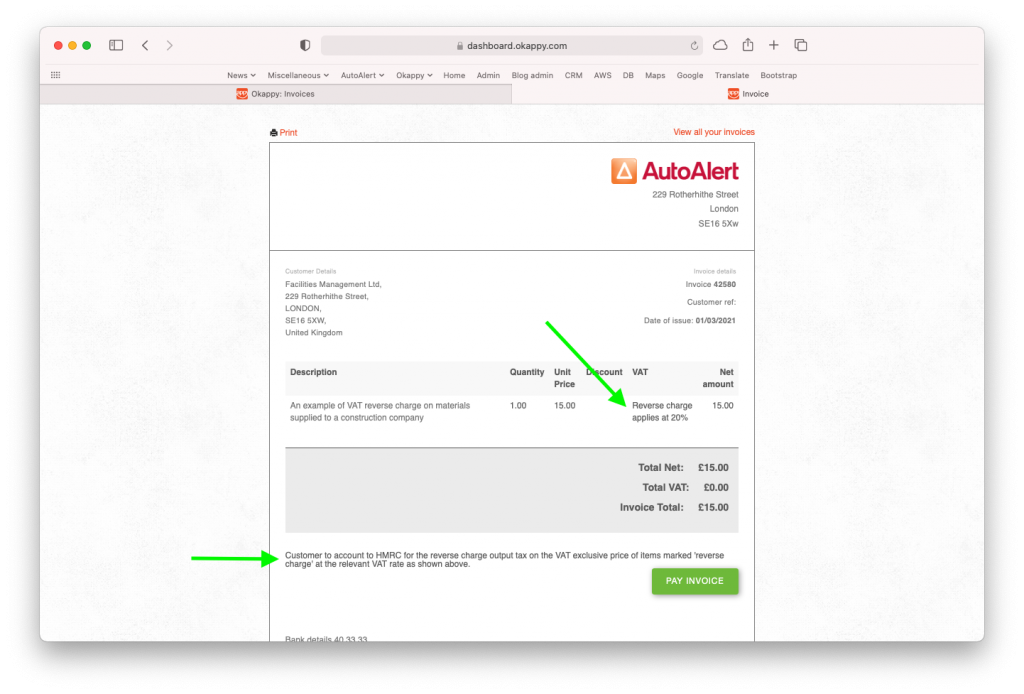

Invoice wording

Invoices should clearly indicate the reverse charge applies. They should show the percentgate of VAT which was charged (whether reduced rate or standard) and have a label advising that the “Customer to account to HMRC for the reverse charge output tax on the VAT exclusive price of items marked ‘reverse charge’ at the relevant VAT rate as shown.

There has been discussion around whether the amount of VAT which would otherwise have been calculated should be shown. The general consensus seems to be that it shouldn’t and certainly mostly other software provides are doing it this way.

I think the fear is that, and particularly with accounting software is that if there is a calculation then the VAT will end up someone in your accounts which it shouldn’t. My feeling also is that it’s the responsibility of the ultimate contractor to calculate the VAT and they shouldn’t be blindly copying your invoices.

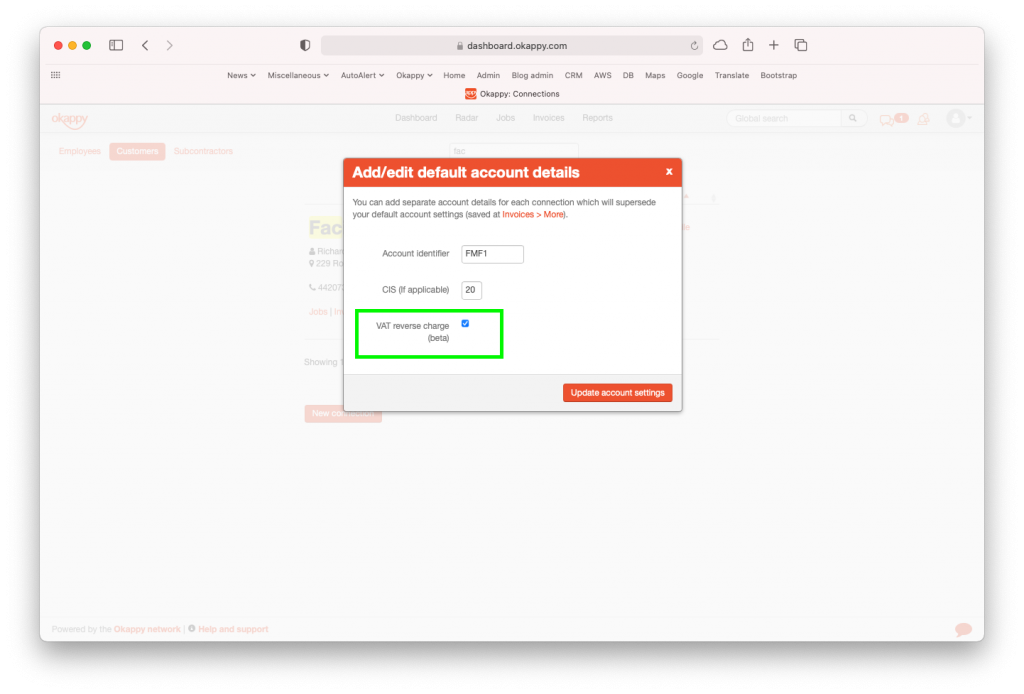

1) Set up your customer within Okappy

Two set up VAT reverse charging on Okappy depends on whether you are using Xero or other.

If you’re not using Xero, you first need to check the VAT reverse charge option in the Connections screen > Customers > Account settings

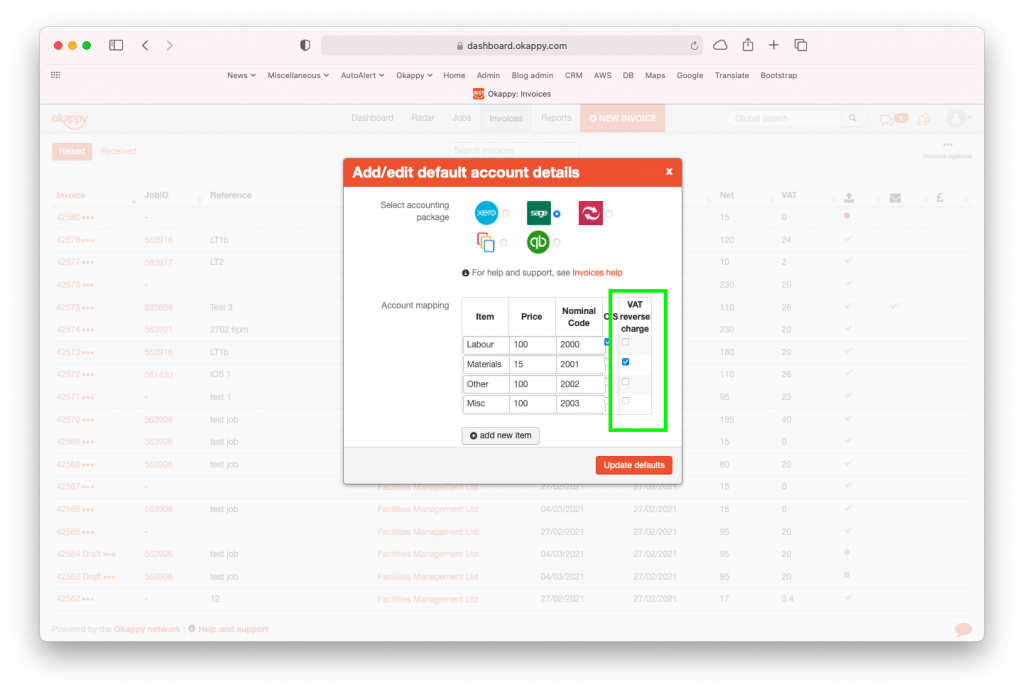

2) Set up your invoice line items

Then set up an item or items which will be used for VAT reverse charge.

This menu is available from the Invoice screen > Invoice options > Account settings

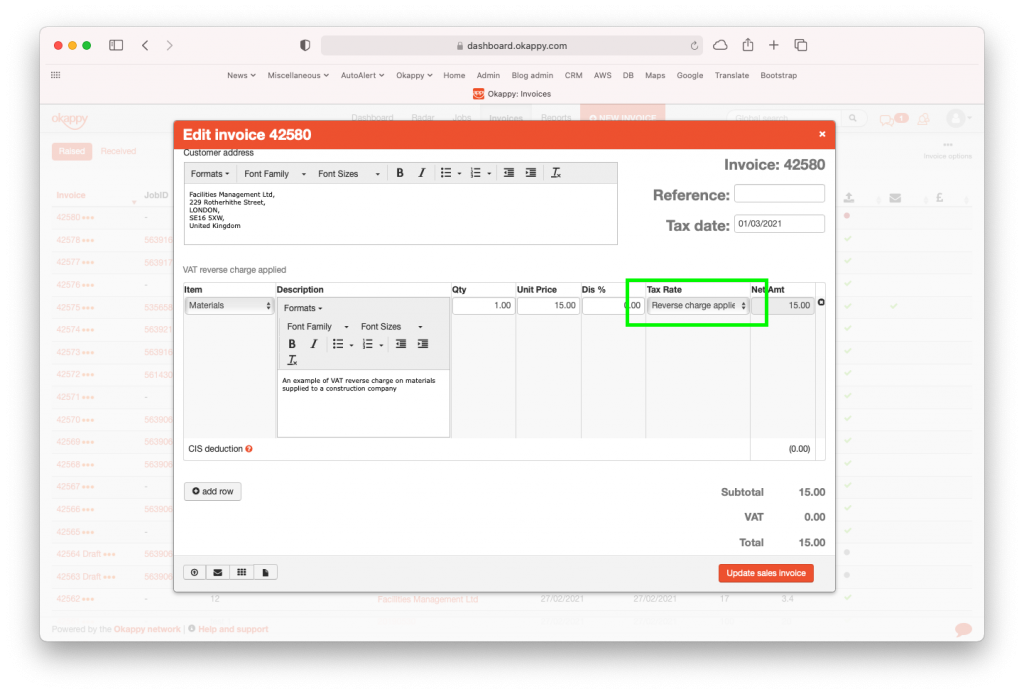

3) Raise your invoices

When you raise your invoices, if you select the VAT reverse chargeable item for a customer that has the VAT reverse charge flag set, then the VAT will be set to Zero and the line will show that VAT reverse charge has been used.

Adding the VAT reverse charge tax rate in Xero

With Xero, it’s a bit different as Okappy pulls in the items automatically from Xero.

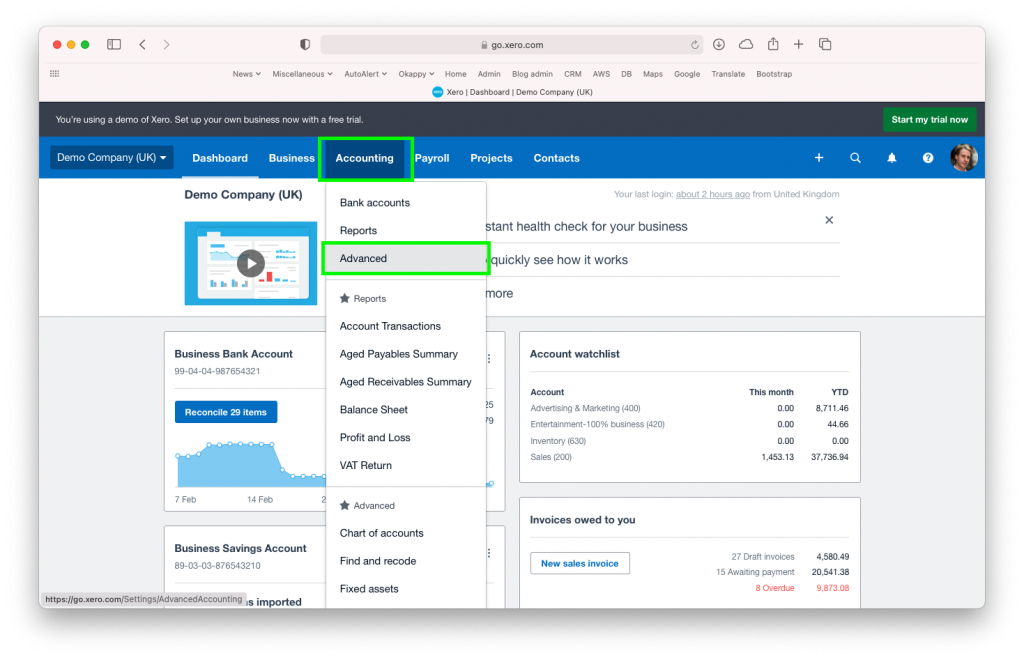

To set up VAT reverse charge in Xero, first go to the Accounting menu within Xero > Advanced > Tax rates

And then add the reverse charge tax rates

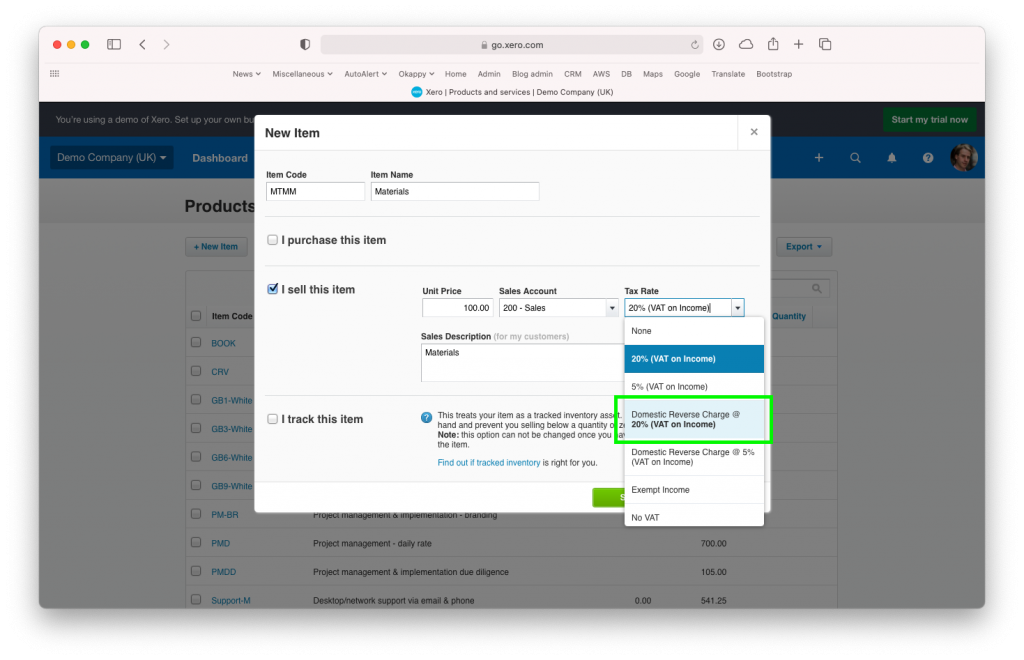

Add or update your products and services

Then from the Business menu, select Products and Services and either add or edit the tax rate on a product or service to use the new VAT reverse charge tax rate.

Raise your invoices

Then it’s the same as before, select the relevant item when raising your invoice and the VAT will automatically be set to Zero and the relevant labels added.

Further information

- https://www.okappy.com/blog

- https://www.okappy.com/support

- https://www.okappy.com/support-article/how-to-raise-a-vat-reverse-charge-invoice/

- https://www.okappy.com/support-article/vat-reverse-charge-with-okappy-and-xero/

- https://www.gov.uk/guidance/vat-domestic-reverse-charge-for-building-and-construction-services#whentouse

- https://www.gov.uk/use-construction-industry-scheme-online

- https://www.gov.uk/employment-agencies-and-businesses

- https://www.gov.uk/government/organisations/hm-revenue-customs/contact/construction-industry-scheme

You can also call HMRC by telephone at 0300 200 3210 (+44 161 930 8706). The VAT Helpline is on 0300 200 3600

View the webinar

Get the webinar slides

Leave your details above and we’ll send out a copy of the slides. We’re also interested to hear of any other topics you may like to hear about for future webinars.