The post Webinar – Getting your invoices paid on time appeared first on Okappy.

]]>Our webinar – Raising invoices and Getting Paid Quicker was on the 19th May 2021.

We were joined by Paul Layte FCA from Next Level Business. Paul is a business growth specialist who has founded several high profile corporate start-ups and has worked in board level roles in four different listed businesses. A chartered accountant by background with a passion for growing businesses of all shapes and sizes which he now does through his own digital chartered accountancy firm Next Level Business where Paul, as the founder and CEO also provides advisory and CFO support to many ambitious small businesses ans SME’s.

Who is Okappy?

Okappy is a business 2 business connected workforce management platform which applies social and market networking technology to a real business need. The need to communicate and collaborate with your employees who are often at different locations (and now more than ever). With your subcontractors and with your customers.

Okappy helps the most forward looking and dynamic companies increase transparency, reduce duplication, costs and errors and increase efficiency. Ultimately making a significant contribution to bottom line profits.

With Okappy, you can connect to your employees, customers and subcontractors.

Send and receive jobs.

See the status of those jobs as they’re updated by your engineers and subcontractors

Then raise your invoices at the touch of a button.

It’s those first three points which I am touching on today.

Late payments are an issue

Late payments are an issue in the UK. Particularly in some of the sectors that customers work in. i..e, construction, facilities management, housing.

Research by BAC, the payment organization, suggests that £32.4 billion is owed which equates to about £35k for the average smaller enterprise.

Late payments are due to a number of factors. What gets the most headlines is large companies delaying payment to improve their own cash flow. But a lot is also due to your own processes. One of the big changes we see in companies that move to digital workforce management is the speed in which invoices can be generated. Systems are obviously part of it, but processes are also key which I’m sure Paul will talk about.

I think what we want you to take away is that late payments can be a headache but there is a lot you can do about it to make the whole process smoother, more efficient and much quicker.

Introducing Paul Layte, Next Level Business

On that note, I’m going to introduce you to Paul.

Paul, CEO and founder of Next Level Business, the Growth Accountants. He has founded, grown and exited several high-profile corporate startups in the telecoms and technology sectors.

He’s worked in board level roles in four different listed businesses and been a non-executive director and chairman of several smaller companies.

Like me, Paul is a keen motorsports enthusiast, Paul likes rugby and reminiscing about past sporting glories in the swimming pool. So maybe that’s a question you can ask him about at the end.

Invoicing Top Tips

When you’re onboarding a customer, ensure they are set up correctly. You know what information is required on their invoices.

Send your invoices as soon as possible. A lot of delays are actually caused by the invoice not going out in the first place.

Ensure it is easy for your customer to pay your invoice. Ensure your bank details are correct, any additional such as IBAN numbers are included and that your business name matches your bank account name.

Also offer different options for your customers. Can they pay by BACs, credit card or debit card.

Monitor the due date of your invoices. And ensure you give your customer a call a week before the invoice is due. This ensures that everything is in order before they attempt payment.

This also entitles you to chase your invoices as soon as it is overdue. If you chase the day after the due date, then your customer will learn that you will always follow up on overdue invoices. If they are looking to delay payments then it’s likely they will delay the invoices from customers they haven’t heard from rather than the ones that make the most noise.

Finally once your customer has paid your invoice. Don’t forget to thank them.

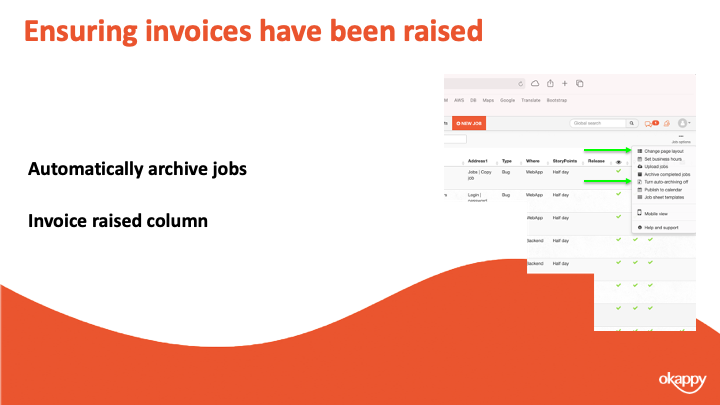

Ensuring Your Invoice has been raised in Okappy

One of the first decision companies make when joining Okappy is how to put in a control to ensure that you have raised your invoices.

A lot of companies we speak to talk about the difficulty of getting job sheets back from their guys, understanding what has been done and then raising an invoice in a timely manner. Particular when companies rely on paperwork or spreadsheets it’s too easy to forget to raise an invoice and we certainly hear that a lot.

With Okappy, there are 2 ways you can keep on top of that process and ensure an invoice has been raised.

1) The first way is to automatically archive jobs once the invoice has been raised. This way you can see at a glance that if there are completed jobs on your dashboard then an invoice hasn’t been raised.

2) The second way is to add the invoiced column to your dashboard. That way you can see a tick once the invoice has been raised.

It’s up to you which process you use, most go with the first as it keeps the dashboard cleaner and helps you see the wood from the trees.

Raising invoices in Okappy

The second step in using a system is to determine how you can raise an invoice.

With Okappy, there’s various ways. You can raise an invoice from a job

You can raise it from a quote or you can raise a miscellaneous invoice.

One thing to note with the network, you can also receive invoices from your subcontractors or suppliers. That includes our invoices to you.

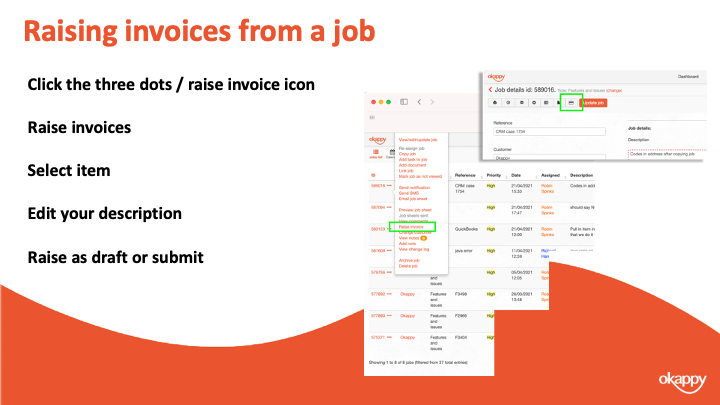

Raising invoices from a job

To raise an invoice from a job

- Click the three dots next to your job

- Select Raise invoices

- Select item (product or service)

- Edit your description

- Raise as draft or submit

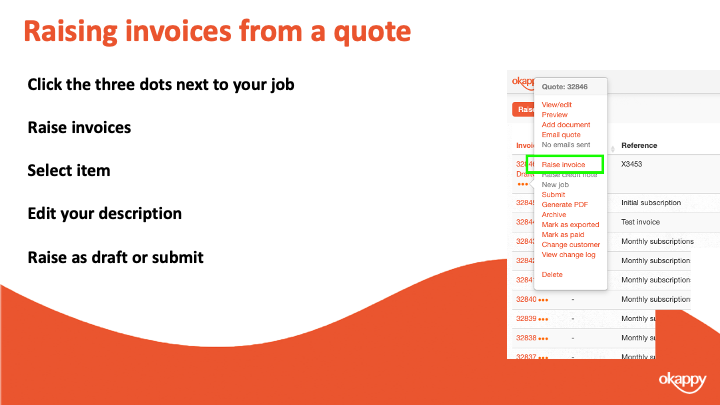

Raising invoices from a Quote

To raise an invoice from a quote

- Click the three dots next to your job

- Select Raise invoices

- Select item (product or service)

- Edit your description

- Raise as draft or submit

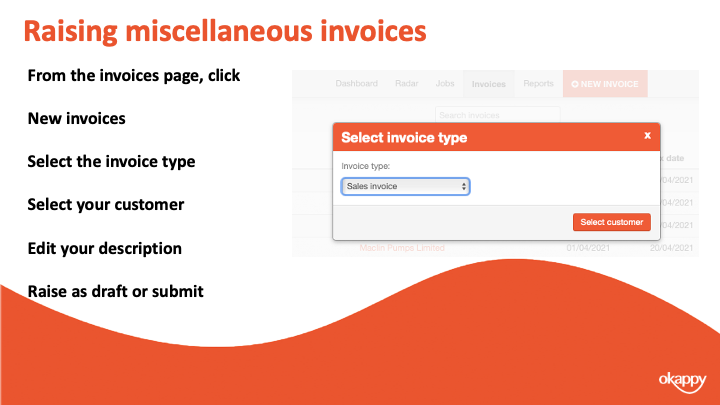

Raising miscellaneous invoices

To raise a miscellaneous invoice

- Click the three dots next to your job

- Select Raise invoices

- Select item (product or service)

- Edit your description

- Raise as draft or submit

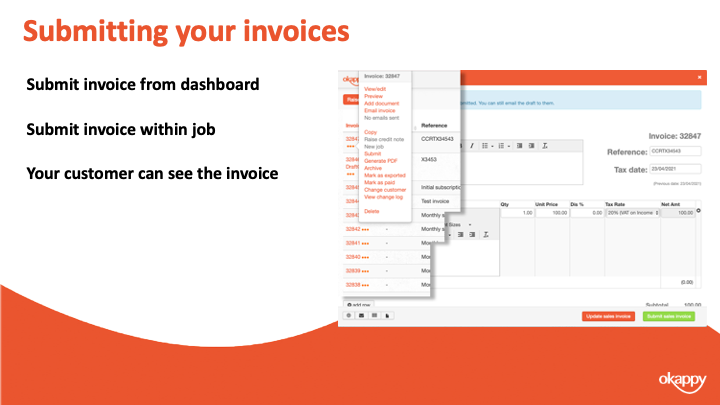

Submitting your invoices

Submitting your invoices.

Changing your invoice from Draft to Submitted means that your customer can view your invoice and pay it (depending on your settings)

Seeing when your invoice has been paid

One thing Paul mentioned was being on top of which invoices have been paid. With Okappy you can look at it at a granular level with each invoice. You can also see how much is owed at a customer level.

The first thing to note is how the invoices actually get marked as paid. There’s three ways this can be done.

- You can manually mark the invoice as paid. To do that click the three dots next to the relevant invoice and click Mark as paid

- If you are using Xero and it’s connected to Okappy, then marking the invoice as paid within Xero will also mark the invoice as paid within Okappy automatically.

- The final way that invoices get marked as paid is if they are paid through Okappy’s own payment gateway. I’ll talk more about that in a bit, but if a customer pays an invoice via Okappy then you will see that the invoice has been paid and when. You can also set up email alerts to notify that an invoice has been paid.

Once an invoice has been marked as paid then this can be seen in three areas.

You can see it in your invoices dashboard, the paid column towards the right of the screen.

You can see it when raising a job. When you select a customer, their outstanding balance is shown which is the value of all invoices raised less those which have been paid.

There’s also a couple of reports – the invoices paid report and the outstanding invoices report which shows which invoices have been paid or not.

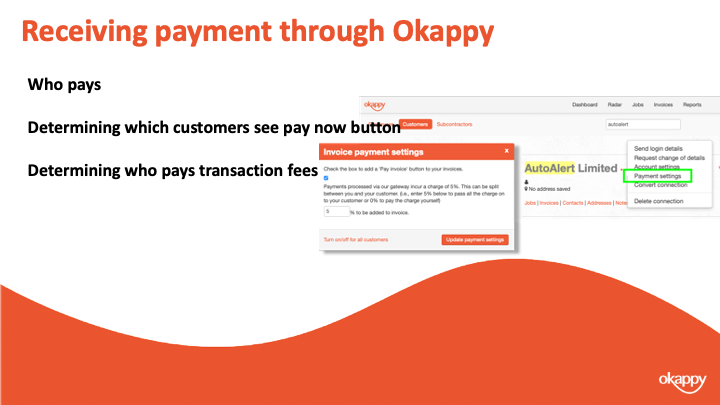

Receiving payments through Okappy

Paul mentioned about making it easy for your customer to pay you.

If you are taking payments through BACS or direct, then ensure your invoice template is updated with all the correct details.

You also have the option to take payment through Okappy. To do this, you simply enable the payment button on your invoices. When a customer clicks the button they’ll be taken to our payment gateway where they can make a secure payment to cover your invoice.

You can determine which customers the button shows for, you can show it on all your invoices or not show it all.

To change the setting for all customers, go to invoice options and then select the payment button link.

To change the settings for a specific customer. Go to the connections screen, find the relevant customer and click Payment settings

The first checkbox determines whether the Pay invoice button shows or not.

You can also set who pays the transaction charge. It can be added to the invoice in which case your customers who pays. It can be taken off the invoices in which case you get the amount of the invoice less the transaction charge. Or you can split the payment between yourself and your customer.

A quick recap

We talked about tips for getting paid quicker including ensure the setup of your customer is correct, ensure invoices are sent in a timely manner and keep an eye on the due date.

Chase as soon as the invoice is due and don’t forget to say thank you

We showed you three ways to raise your invoices on Okappy. From a job, from a quote and a miscellaneous invoice.

We showed various ways that you could see whether an invoice has been paid or the value of all invoices outstanding.

Finally we discussed using the pay now functionality from within Okappy to automate your process and make it easier for your customer to pay your invoices.

Further information and support

There’s lots of information on our help and support pages including help articles, questions and answers and videos.

Here’s some links to articles which we have covered today.

https://www.okappy.com/support

Invoices

https://www.okappy.com/support/invoices

https://www.okappy.com/support-article/how-to-raise-an-invoice-from-a-job/

https://www.okappy.com/support-article/view-all-your-invoices-raised-from-the-invoices-screen/

https://www.okappy.com/support-article/taking-payments-via-okappy/

https://www.okappy.com/support-article/updating-your-invoice-template/

Reports

https://www.okappy.com/support/reports

https://www.okappy.com/support-article/invoices-raised-report/

https://www.okappy.com/support-article/invoices-for-customer-report/

https://www.okappy.com/support-article/outstanding-invoices-report/

https://www.okappy.com/support-article/paid-invoices-report/

A number of short, self explanatory videos are also available.

Thanks for attending our webinar

Thanks once again for attending our webinar. I hope you found it useful.

Please connect with Okappy on twitter at @ok_appy or follow us on LinkedIn at https://www.linkedin.com/company/okappy-ltd-

You can also follow Next Level Business at on twitter at @_nlbusiness or on LinkedIn at https://www.linkedin.com/company/next-level-business

View the webinar

Get the webinar slides

The post Webinar – Getting your invoices paid on time appeared first on Okappy.

]]>The post Interview With Kale Grieve: Managing The Workforce appeared first on Okappy.

]]>Liquid and Gas Ltd is a residential maintenance company who cover domestic issues for real estate, including painting, decorating, plumbing, heating, electrical work, gas leak inspection, electrical tests, damp and mould issues, and joinery. For anything that goes wrong inside the property, Liquid and Gas Ltd are the people who go out and tend to the problems. They also do commercial gas related work. We spoke to Kale Grieve, director at Liquid and Gas Ltd, to find out how he’s managing his workforce at the moment.

How big is the company?

“At the moment we have about 10 employees and 4-5 subcontractors.”

Whereabouts are you based?

“Orton at the moment. Then I’ve got offices in Skelmersdale as well.”

When did you start using Okappy?

“Less than 12 months ago.”

How did you initially discover Okappy?

“I was looking for a dispatch software, as we were getting bigger and bigger. I was managing everything myself, which involved getting the work and distributing it to the guys. We were growing and growing, and managing the workload in the way that I was just wasn’t sustainable. I needed a software which could efficiently do it for me, instead of me trying to remember every single job that we had!”

Were you using a paper-based system before?

“Do you know what? It was just me which was very very draining! We were using email to send a job through. Sending guys to the job was the easy part, but actually recording what was happening on site was the part that was a challenge. It involved being able to relay that information back to real estate or to a customer. A lot of it was done through memory, or calling the engineers to confirm details. We didn’t have a proper papertrail! But now, we have a digital paper trail with the Okappy app.”

What’s been the main difference before and after using the system?

“It’s black and white for us. We wouldn’t be able to function without it now because, obviously, since then we’ve expanded. My business can run without me. Prior to that, there was just no possible way for that to happen – I had to be there. I couldn’t take time off for a holiday. When I was off, the whole company was off. When I did take some time off, my phone wouldn’t stop asking for information regarding work and jobs – it was just non stop. But now I can leave that to others, as all the information is on the Okappy system.”

Could you give any figures or numbers to describe how much you’ve grown?

“Yes, we’ve now got twice as many staff since we started. We’re constantly expanding! The business growth is something that Okappy has aided, but it’s not solely down to Okappy. Okappy has helped us to expand more smoothly due to having a more streamlined process.”

How much time has it saved you on average? Do you have any idea of hours per week?

“It’s saved me as an individual, around 20-30 hours a week, which is over half my working week! Overall for the company, it’s a lot more than that.

Before we had Okappy, sometimes all I would do is work and sleep. Now, I have the time to go out on site a lot more – it frees me up a lot more. When I finish work, I finish work. As opposed to “finishing work” and going home to continue working all night. It’s massive for us. Absolutely massive.”

Has the time given you space for thinking about how you want to grow in different areas of the business? For example, are you investing more in marketing now?

“I’ve never advertised. I have companies call me up about my website and stuff like that, but we don’t need it. We grow through getting positive ratings on feedback from tenants. Now we’ve got Okappy, we’re a lot better with time keeping. We have better access to the details on the site to call them up and let them know if we are going to be delayed. Obviously, the improved reliability has resulted in helping us grow. And I’d certainly say it’s helped us get more contracts and work better within our current contracts.”

Do you have a favourite feature?

“I know my guys like the address capabilities – the way that we can just click on the address and then we’re on our way. And the ability to just click on the phone number and text or call them to say, “Listen, we’re on our way back.” That’s massive for us.

For me, it’s more the ability to have a meeting where I can just switch back and go, “Okay, you went to 13 Tylney Street last week. I’ll get that from the archive and check the work order and job sheets,” which I can then send off to my tenants, customers or the landlord to show them the real state of their property. The landlord may not have seen their property for years, but I can show them the images of what’s going on inside by sending a job sheet with attachments from the job!

I love the job sheet side of it, whereas the guys who are out and about like the instant access to contact details on the map view where you can just click on a button and it directs you which way to go.”

How has Coronavirus affected your business and has Okappy helped you adapt?

“Well, we’ve got a lot less work just because tenants have prioritized more of their own health than whether the tap’s dripping or that light switch doesn’t work and stuff like that. Obviously, a lot of our guys are furloughed and we’ve been using more subcontractors. We’ve been affected massively from it – it’s just been me and a skeleton crew really. We currently have only one person in the office.”

How would things be different if you didn’t have Okappy during Covid-19?

“Just harder to get money in really! Okappy has 100% helped with the cash flow side of things. Without job sheets, it would be a hard task for me – a lot of invoices would get left unpaid. But with Okappy, we can easily remind them with the job sheet to send the payments through. Without Okappy, we’d probably have less invoices being paid to help us get through this period.”

Last question, then. What would your message be to anyone thinking about using Okappy?

“We can actually – right now – log every single job on the database. At the click of a button, we can send guys to certain jobs. They can find the job information easily and add important details to the job sheet. I used to spend 30-40 hours a week calling guys to try and get information. But now, it’s all there for me on the app!

I now work so many less hours a week. I can actually go on holiday and enjoy myself. I don’t have to be constantly on the phone every minute. It’s made my life so much easier. I don’t know what we’d do without it. Using Okappy is a no brainer!”

Be the first to hear

Leave your email below to stay up to date with our latest tips, tricks and trends on all things business?

The post Interview With Kale Grieve: Managing The Workforce appeared first on Okappy.

]]>The post Neet Maintenance’s new way of managing work appeared first on Okappy.

]]>Featured in Drain Trader Magazine, issue 265. May 2020

Neet Maintenance is a company offering a wide range of trades for building projects, including plastering, tiling, carpentry, plumbing, electrical work, landscaping and brickwork. They work with companies like Abby Homes, Linden Homes, and Persimmons, primarily working on new build projects prior to people moving in.

As the company was expanding, they needed to find a better way to manage their workforce and decided to implement Okappy in January 2020. We spoke to Wendy, the Customer Care Administrator for Neet Maintenance, to find out how it’s working for them.

What made you decide on Okappy?

I joined the company at the beginning of January 2020 and the company was operating on a completely paper-based system. They were expanding so we needed to find a system that was compatible with the office and all the guys out in the field. The Office Manager had looked at one or two digital management systems, but they seemed quite complicated.

We do all the new builds and do all the snagging after customers have moved in. It depends on a day-to-day basis how many jobs they give us. We needed a system that could help us handle a sudden influx of jobs. We found Okappy through Google and the system was a lot easier to use. After the free trial, we decided we just needed to implement it!

How big is the company?

There are 3 of us in the office, the MD who is out and about all the time, and then we have approximately 30 operatives on site. We mainly use Okappy to manage the maintenance guys who I deal with. We’re taking on even more people in the next few weeks, which will also impact how many people we have on the system.

What are the main differences you’ve noticed before and after using Okappy?

Due to the amount of extra staff we were taking on, the paper was becoming too hard to handle! We were sending job information back and forth via photos on Whatsapp. Then when they were finishing, they were doing the same back. With regards to the actual worksheets themselves, we were having to chase the guys to get them to bring them back into the office. We don’t have to do any of that now, because they just upload everything to the system straight away!

How much time has it saved?

It’s got to be a good 2 or 3 hours a day overall. We’re just starting to use it on the invoice side as well, and foresee it saving us a lot more time in the future once we’re more used to it. We’re also saving money on printing and paper costs!

Do you see Okappy as an integral part of your business growth?

Definitely, unless something drastically changes, we won’t be using anything other than Okappy. We’re very happy with the system, as it’s so user friendly. I don’t consider myself to be someone who’s very good with computers, but if I can use it – it’s got to be good!

We cover Northamptonshire, Bedfordshire, and are going down to Essex and Hertfordshire. As we’re increasing the workload, the area is increasing! I can see the area we cover growing now we have a more efficient system too.

What’s your favourite feature?

Just the fact that I can zap all the job information to our workforce straight away! It goes onto their app, and once they’ve completed it, I get everything back again, which enables us to send the photographs and the worksheets back to our clients within 24 hour. Before using Okappy, it could take up to 3 or 4 weeks to send all the information back, depending on when the guys could get back into the office!

What’s your message to anyone thinking of using Okappy?

Just go for it! It’s like anything – it’s trial and error, but because it’s so user friendly, it doesn’t take you long to get the hang of it. It makes your life easy, especially when you’ve got a mobile workforce, because the ease of getting the information back and forth is really quick!

Be the first to hear

Leave your email below to stay up to date with our latest tips, tricks and trends on all things business?

The post Neet Maintenance’s new way of managing work appeared first on Okappy.

]]>The post 5 Ways to Minimise Costs in the Drainage Industry appeared first on Okappy.

]]>Featured in Drain Trader Magazine, issue 260. December 2019

Why Minimise Your Costs?

One of the most common reasons for business failures is cash flow problems. Cash flow problems are most often caused by a failure to control costs.

There are many factors that affect controlling costs in business. For example, quiet patches, unnecessary expenditures, poor waste management and cost inefficiencies. Sometimes identifying these inefficiencies can be obvious. But this is not always the case, and it will often need a more thorough investigation.

When making cost minimising decisions it’s important to:

- Prioritise continued sustainability and improving prospects for growth

- Be prepared to make necessary sacrifices

- Keep in mind how these decisions will impact staff and customer perceptions

- Prepare yourself for old routines to change as you make way for new ones

Here are 5 key areas drainage companies need to address when minimising costs:

1. Suppliers

It’s common for companies to be reluctant to change their suppliers because they’ve built up a sense of obligation and loyalty. Long-lasting relationships are worth protecting, but it may be an unnecessary expense for your business.

Re-evaluate your suppliers and assess whether you could be getting better value for your money elsewhere.

If you communicate to them your intentions to cut costs, they may offer you a better deal to keep your custom. If not, research alternatives without burning any bridges.

This includes also the external companies you outsource workers from. Are they reputable? Are they all properly certified? If not, they could be losing you valuable clients.

2. Seasonal Changes

The drainage industry is affected by external factors such as location, weather conditions and holidays. Keeping track of the number and type of service requests will enable you to make forecasts as you approach different times of the year.

Cold weather and demand on facilities can cause pipes to burst and periods of heavy rain can cause basement flooding. Keeping track of the busy periods can allow you to plan in advance. Likewise for quieter seasons; you can scale back your costs where possible.

3. Business Strategy

Make it part of your business strategy to create a cost cutting plan. Every month audit your expenses and assess what has been a worthwhile spend or not.

Many things impact upon costings including fluctuations in supply and demand, the state of the economy and new technologies. Implementing a consistent review of financials will allow month-over-month comparisons, and year-over-year comparisons. You’ll be able to spot seasonal trends, predict future profits or losses over various timeframes, and set new goals.

You will then be in a better position to plan for big expenses in advance and balance out risks. Put in place cost reviews into your business strategy and you will be well on your way to managing and minimising your expenditure.

4. Communication

Maintaining good communication amongst company employees and external stakeholders may not sound like an obvious way to help minimise costs, but according to a Gallup survey, businesses in the top quartile of employee engagement averaged 12% higher profitably.

Good communication in companies contributes towards a high job satisfaction. Maintaining good communication and a culture of transparency will help build trust and confidence in the company. When employees feel listened to, they feel valued and more inclined to perform their tasks well.

When there are workers performing various jobs at multiple locations at any one time it can be difficult to keep track of what is going on. Network technologies like Okappy’s workforce management software improve communication for companies on-the-go. Their location-tracking, real-time messaging and job-adding features ensure that the job gets done as cost-effectively as possible.

5. Software and Technology

Are you utilising time-saving and money-saving softwares to manage jobs? With so many digital systems available, there is no need to be using paper job sheets and invoices.

Manual inventory counts and reporting are not only inefficient, but they also increase the risk of human error. A single error can have a large impact on a companies’ profitability. Traditional management systems take up lots of time and information often getting lost in the process.

Workforce management software like Okappy enables companies to log everything on a database. Instead of hunting for hours in various places for one job sheet, the data for past, present and future jobs is available to access at any point.

Investing in online bookkeeping and accounting software like Xero will allow you to analyse expenditure in no time at all. This will help you identify areas where you need to make cuts to allow your business to be more profitable.

Be the first to hear

Leave your email below to stay up to date with our latest tips, tricks and trends on all things business?

The post 5 Ways to Minimise Costs in the Drainage Industry appeared first on Okappy.

]]>